How To Collect Client Payments

For bandleaders and admins

Reuben Avery

Last Update há 2 anos

Each booking you create has a unique “Client Portal” where the invoice and contract for that booking live permanently. Once your client has their client portal link, they can visit any time to sign and review their contract and/or make invoice payments.

So basically...

- You create the booking invoice and contract

- Click on the “Send Contract & Invoice” button

- Send an email to your client with the “Client Portal” link in the footer (this is automatic)

- Your client accesses their portal and pays you

Simple.

What Payment Methods Are Available Inside Back On Stage?

By default, your clients have a few different “payment method” options for posting payments to invoices within the Client Portal:

- Cheque(Check) or eTransfer - choosing this will notify you that the client is sending a cheque or eTransfer. You will need to confirm receipt later. Please note: this option DOES NOT MOVE MONEY. It simply allows the client to indicate that they are sending you money via the selected method.

- Credit Card or PayPal - choosing this lets your client send an instant payment. You receive the funds in your PayPal account.

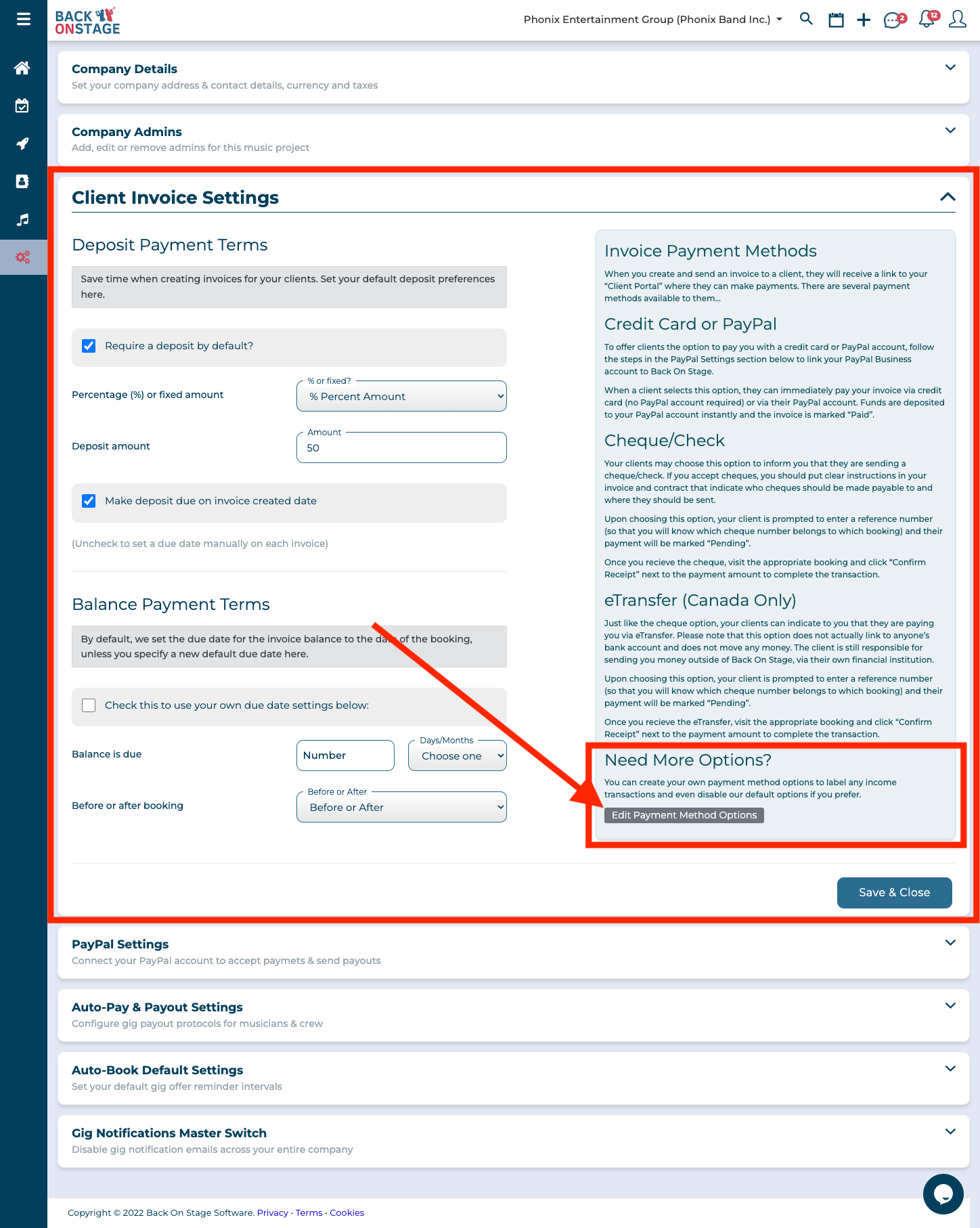

You can also customize the list of payment method options in Company Settings > Details > Client Invoice Settings:

Credit Card Processing Fees

Whenever you use PayPal to process a client payment on a BOS invoice, PayPal will charge a small transaction fee. Depending on your country, this fee varies, but is usually around:

- 2.9% + $0.30

Learn about PayPal fees in your area here.

Keep in mind that clients are 8X more likely to tip you if the can pay with a credit card, and our data shows that you’ll easily cover card processing fees with these tip amounts.

IMPORTANT: Before you can accept credit card payments from clients, you’ll need to connect your Back On Stage account to your PayPal Business account. Go to Company Settings > Details, and click on “PayPal Settings”.

PRO TIP:

Use your “Test Company” to run some test payments and experiment with different payment methods. By testing, you can ensure your payments come through as expected and you can familiarize yourself with the client checkout workflow.

Charge the Processing Fee To Your Client

Think twice before you consider adding a "credit card processing fee" to your client invoices.

No one likes being surprised by additional fees just when they're ready to make a payment, and you don't want to risk souring the relationship with your client. Also, this should not come as a surprise, so make sure you state this clearly in all your pricing materials if you want to go this path.

As a better option, consider building the fee into your regular pricing, just as you have done with all your other business expenses. Your other day-to-day business expenses, such as utilities, software subscriptions, uniforms, bookkeeping, accounting and insurance, don't belong on your client invoices, and neither does a credit card processing fee.

Consider that your clients may be eager to pay with a card since they're making a big purchase and the points they earn from a transaction that size could be a huge help for them. If you simply bump up your pricing by 3% today, your future clients won't even notice. But they'll be happy they can pay you with a credit card and you'll be happy that the fees are covered.

And if you really just have a big loyalty to cash, there's no harm in offering your clients a "3% discount" if they pay with cash. Wouldn't you rather see a discount opportunity on a bill than a mandatory fee?

As a bonus, have found that clients are 8X more likely to leave you a tip when they pay by credit card, and the TIP option in the BOS client portal makes that easy for them. Plus, you’re likely to make 3.5X more tip revenue, just by accepting credit card payments (read more).